This Week In Business

Print’s not dead. How Hearst is using social to power-up its papers.

Analizo launches Europe's first algorithm-as-a-service, bringing robo-investing capabilities to the wealth management industry

Applegreen wins prestigious European SME Award

Mimaki Tx300P-1800 already proving a Fashionable Choice

Irish Stock Market

Applegreen wins prestigious European SME Award

Star of 2016 award won by Applegreen Applegreen, the #1 motorway service area operator in…Irish Stock Exchange Quarterly Statistics Q3 2016

Q3 2016 statistics show over 35,000 securities listed on Irish Stock Exchange markets…ISE shows growth

Irish Stock Exchange listing figures grow to over 35,000 securities Quarterly statistics…Irish Stock exchange extends to 28 companies

Dalata Hotel Group joins the ISE’s Main Securities Market Dalata Hotel Group (Dalata),…#IPOready companies graduate from ISE leadership programme

High-potential companies have graduated from #IPOready #IPOready is the Irish Stock…Quarterly Statistics - Irish Stock Exchange

Q1 2016 statistics show 34,382 securities listed on ISE markets. Main headlines: Listings…ISE The Place To Be!

Irish Stock Exchange wins No.1 slot in Great Place to Work Awards. Would you like a great…Venn Life Sciences Joins The ESM

Adding a euro quotation for investors. Venn Life Sciences, the growing Contract Research…

World Economy

Print’s not dead. How Hearst is using social to power-up its papers.

The Newspaper business is dead? Don’t tell that to Hearst. By Brett Lofgren | September…Press Release From ISE

ISE and NASDAQ OMX announce intention to bring Dual ISE/US Market Access to Irish…Sappi First-Quarter Profit Falls

Company says result is due to paper and pulp price decline. Sappi Ltd., the world’s…How global manufacturing is changing.

Ireland is changing and the savvy business has to be aware of changing global trends.3D…High Consumption Foodstuffs in DRC:

High Consumption Foodstuffs in DRC: Where Are the Surpluses and Deficits? By Dr…Xerox wins print contract for UK Government

Xerox to deliver cost efficiencies in print services to UK public sector The UK Cabinet…Disposable income drops

New figures just released show that household disposable income in Ireland fell by 0.4…Ireland’s richest 300 worth €62bn

The 300 richest people in Ireland are now worth more than €62bn. The figure is staggering…

Business & Finance

Applegreen wins prestigious European SME Award

Irish Stock Exchange Quarterly Statistics Q3 2016

ISE shows growth

Irish Stock exchange extends to 28 companies

#IPOready companies graduate from ISE leadership programme

Quarterly Statistics - Irish Stock Exchange

World Stock Market

Hans‐Ole Jochumsen re‐elected as FESE President

Euro rates fixed – but for how long?

GLOBAL STOCKS and COMMODITIES

Snapshot of Irish shares and European stocks over Christmas

Markets surge on Central Banks' intervention

U.S. Stocks Update Wednesday 23rd November 2011

Economy, Tenders & Invenstment

Prior information notice of tender.

Tender Opportunity Here at DPNlive, we are always looking for business opportunities for…Print tenders

Want to do the printing for the Houses of the Oireachtas? Below is a table of three…

- Details

- Written by Administrator

- Parent Category: Business and Finance

- Category: Company News/Finances/Banks

Enterprise Ireland has created a €200,000 pilot competitive feasibility fund to stimulate start-ups in the south-east.

A new company can receive up to €25,000 if it can demonstrate its job-creating potential in the region.

It appears that only those companies involved in ICT, manufacturing and food are eligible to apply, however.

Enterprise Ireland says the fund aims to accelerate the growth of start-up companies that can clearly demonstrate an ability to be successful in global markets.

As with all such potential funding, many hours of hard work and form filling will be required to successfully access this new financial support. Initiatives such as these, however, are welcome and play an important role in helping to generate jobs.

The closing date for applications is January 30th and the first awards are expected to be made available soon after that.

Copyright © 2011, DPNLIVE – All Rights Reserved

- Details

- Written by Administrator

- Parent Category: Business and Finance

- Category: Company News/Finances/Banks

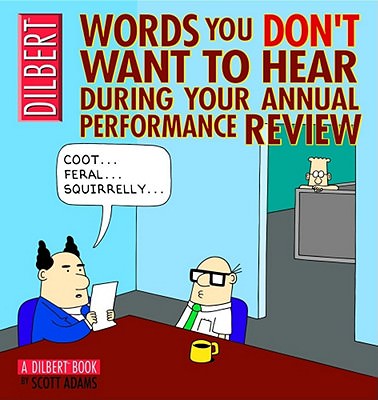

• OUTGOING PERSONALITY - Always going out of the office

• GREAT PRESENTATION SKILLS - Able to bullshit

• GOOD COMMUNICATION SKILLS - Spends lots of time on phone

• WORK IS FIRST PRIORITY - Too ugly to get a date

• ACTIVE SOCIALLY - Drinks a lot

• INDEPENDENT WORKER - Nobody knows what he/she does

• QUICK THINKING - Offers plausible excuses

• CAREFUL THINKER - Won't make a decision

• USES LOGIC ON DIFFICULT JOBS - Gets someone else to do it

• EXPRESSES THEMSELVES WELL - Speaks English

• METICULOUS ATTENTION TO DETAIL - A nail picker

• HAS LEADERSHIP QUALITIES – is tall or has a louder voice

• EXCEPTIONALLY GOOD JUDGEMENT - Lucky

• KEEN SENSE OF HUMOUR - Knows a 101 of dirty jokes

• CAREER MINDED - Back Stabber

• LOYAL - Can't get a job anywhere else

• PLANS FOR PROMOTION/ADVANCEMENT - Buys drinks for all the boys

• 0F GREAT VALUE TO THE ORGANISATION - Gets to work on time

• RELAXED ATTITUDE - Sleeps at desk

- Details

- Written by Administrator

- Parent Category: Business and Finance

- Category: Company News/Finances/Banks

AIB HAS sold its investment management division to Prescient Holdings, a South African financial services group. Although the sale price was not disclosed it is believed that Prescient paid AIB between €25 million and €30 million.

AIB HAS sold its investment management division to Prescient Holdings, a South African financial services group. Although the sale price was not disclosed it is believed that Prescient paid AIB between €25 million and €30 million.

In a statement to the Irish Stock Exchange, the bank said the positive impact on AIB Group’s capital position as a result of the transaction was “not material” due to the small size of the transaction.

AIB Investment Managers will be renamed Prescient Investment Managers (Ireland) Limited once the sale is concluded, which observers believe will take place sometime in the in the first quarter of 2012. The bank anticipates that regulatory approval for the sale will be straightforward. AIBIM, was established in 1966, and it employs approximately 100 people with offices in Dublin and New York. As of September 2011, the division managed assets of €8.5 billion for private, corporate, pension and charity clients.

AIB identified the division as a non-core asset which had to be sold as part of the State-owned bank’s recapitalisation and restructuring agreement with the Government and the EU.

In February of this year Irish Life was chosen as the preferred bidder and sources in the banking world said that this bid was expected to generate €15-€20 million for the unit. However, Irish Life pulled out of the running in April.

Although it is understood that several new bids were submitted, AIB entered exclusive talks with Prescient in October.

Copyright © 2011, DPNLIVE – All Rights Reserved

- Details

- Written by Administrator

- Parent Category: Business and Finance

- Category: Company News/Finances/Banks

Sappi, a major pulp and paper producer has announced that its 2011 financial year was somewhat eventful, due to a major restructuring of its under-performing businesses as well as significant investment in future growth.

Sappi, a major pulp and paper producer has announced that its 2011 financial year was somewhat eventful, due to a major restructuring of its under-performing businesses as well as significant investment in future growth.

CEO Ralph Boëttger said:

"Our focus on strategic interventions and the important decisions we have taken have significantly reduced the cost base of the business, enabling us to better manage capacity and positioning us for growth."

The group announced a number of major investments in its North American operations. Sappi Fine Paper North America is to convert the Cloquet Kraft pulp mill to chemical cellulose at a cost of US$170 million. This is planned to come on line in 2013 and should allow the production of 330,000 metric tons of chemical cellulose per year.

Sappi also plans to upgrade coated paper capability at its Somerset Mill which it estimates will cost US$13 million.

Boëttger added that the investments reflect Sappi's confidence that the North American region can play a significant role in the global chemical cellulose market, complementing already strong market positions in release and fine papers.

Sappi however confirmed that conditions in many of its markets remained uncertain throughout the past quarter. In the chemical cellulose business, global demand showed some signs of softening largely as a result of lower growth in China although the group sold a record 190,000 tons of chemical cellulose during the quarter.

The cost base prices of Sappi's major inputs of wood, pulp, energy and chemicals were approximately US$290 million which was higher than in 2010 and affected margins in all of its businesses.

Boëttger also reported:

"The cost base has been reduced throughout company,” he said. “The restructuring and interventions that we have done are now starting to pay dividends - both fixed and variable costs are coming down. Overall our 2012 costs are expected to be significantly lower than 2011."

During the quarter, Sappi’s North American business and Southern African chemical cellulose business performed well, while the European business generated positive operating profit excluding special items.

For the full year Sappi reported a basic loss per share of 45 cents from earnings per share of 13 cents in 2010.

On a cautionary note, Boëttger said market conditions remained uncertain going forward, making it difficult to forecast demand globally.

- Details

- Written by Administrator

- Parent Category: Business and Finance

- Category: Jobs

GP Digital is Hiring: Printer/Production assistant & Mac operator

GP Digital is a city centre based digital printing company. Offering both large and small format printing to a variety of diverse sectors including graphics, creative, communication, professional, government, retail & many more.

We are seeking a self-motivated, hard-working individual that will add value to the company. GP digital is a growing business offering opportunity for career progression.

Artisan Ireland

The Sweetest Thing

The Sweetest Thing. By Tom Byrne.Scratch the surface of Irish industry and you will find…Donegal’s Liquid Gold – Pure Rapeseed Oil

Donegal’s Liquid Gold – Pure Rapeseed Oil The healthy cooking oil favoured by Celebrity…A simply rural life at Waterfall Farm

by Hannah Bolger People are keen to connect with where their food is coming from…Tastefully Yours

Artisan producers of a delightful range of handmade chutneys, preserves, and…MILEEVEN Bees--Sarah's Honey

Mileeven Fine Foods was established in 1988 by my mum, Eilis Gough from her hobby of…Glebe Brethan Farmhouse Cheese

by David Tiernan In 1987 we won supplier of the Year Award from Drogheda and Dundalk…Graham Roberts - Connemara Smokehouse

My name is Graham Roberts and I live and work in a small fishing village, Aillebrack near…CIARA’S PANTRY: It's a Family Affair

By Ellen Neumann13th April 2012 Ciara O’Dowd grew up in the hospitality industry. Her…