This Week In Business

Print’s not dead. How Hearst is using social to power-up its papers.

Analizo launches Europe's first algorithm-as-a-service, bringing robo-investing capabilities to the wealth management industry

Applegreen wins prestigious European SME Award

Mimaki Tx300P-1800 already proving a Fashionable Choice

Irish Stock Market

Applegreen wins prestigious European SME Award

Star of 2016 award won by Applegreen Applegreen, the #1 motorway service area operator in…Irish Stock Exchange Quarterly Statistics Q3 2016

Q3 2016 statistics show over 35,000 securities listed on Irish Stock Exchange markets…ISE shows growth

Irish Stock Exchange listing figures grow to over 35,000 securities Quarterly statistics…Irish Stock exchange extends to 28 companies

Dalata Hotel Group joins the ISE’s Main Securities Market Dalata Hotel Group (Dalata),…#IPOready companies graduate from ISE leadership programme

High-potential companies have graduated from #IPOready #IPOready is the Irish Stock…Quarterly Statistics - Irish Stock Exchange

Q1 2016 statistics show 34,382 securities listed on ISE markets. Main headlines: Listings…ISE The Place To Be!

Irish Stock Exchange wins No.1 slot in Great Place to Work Awards. Would you like a great…Venn Life Sciences Joins The ESM

Adding a euro quotation for investors. Venn Life Sciences, the growing Contract Research…

World Economy

Print’s not dead. How Hearst is using social to power-up its papers.

The Newspaper business is dead? Don’t tell that to Hearst. By Brett Lofgren | September…Press Release From ISE

ISE and NASDAQ OMX announce intention to bring Dual ISE/US Market Access to Irish…Sappi First-Quarter Profit Falls

Company says result is due to paper and pulp price decline. Sappi Ltd., the world’s…How global manufacturing is changing.

Ireland is changing and the savvy business has to be aware of changing global trends.3D…High Consumption Foodstuffs in DRC:

High Consumption Foodstuffs in DRC: Where Are the Surpluses and Deficits? By Dr…Xerox wins print contract for UK Government

Xerox to deliver cost efficiencies in print services to UK public sector The UK Cabinet…Disposable income drops

New figures just released show that household disposable income in Ireland fell by 0.4…Ireland’s richest 300 worth €62bn

The 300 richest people in Ireland are now worth more than €62bn. The figure is staggering…

Business & Finance

Applegreen wins prestigious European SME Award

Irish Stock Exchange Quarterly Statistics Q3 2016

ISE shows growth

Irish Stock exchange extends to 28 companies

#IPOready companies graduate from ISE leadership programme

Quarterly Statistics - Irish Stock Exchange

World Stock Market

Hans‐Ole Jochumsen re‐elected as FESE President

Euro rates fixed – but for how long?

GLOBAL STOCKS and COMMODITIES

Snapshot of Irish shares and European stocks over Christmas

Markets surge on Central Banks' intervention

U.S. Stocks Update Wednesday 23rd November 2011

Economy, Tenders & Invenstment

Prior information notice of tender.

Tender Opportunity Here at DPNlive, we are always looking for business opportunities for…Print tenders

Want to do the printing for the Houses of the Oireachtas? Below is a table of three…

- Details

- Written by Administrator

- Parent Category: Business and Finance

- Category: Company News/Finances/Banks

Was it Overpriced?

How HP paid $18 billion too much for the purchase of three companies.

21st November 2012

In 1939 HP was founded in Palo Alto and it has gone from strength to strength. Throughout all those years however, it has not always gone well. They have brought a number of products to the market that have not been particularly successful, have entered a few markets that were not their forte and have purchased a few companies they shouldn’t have, and some they shouldn’t have bought for the price they paid.

In 1939 HP was founded in Palo Alto and it has gone from strength to strength. Throughout all those years however, it has not always gone well. They have brought a number of products to the market that have not been particularly successful, have entered a few markets that were not their forte and have purchased a few companies they shouldn’t have, and some they shouldn’t have bought for the price they paid.

One of those was Autonomy. In 2011, they paid $10.3 billion. At that stage, they were the world’s largest computer maker. Analysts asked at the time, if HP was paying too much for this company. Autonomy specialised in analysing ‘unstructured’ data – that is data that is not in neat data bases.

This week, on 20th November, HP admitted that they paid too much. $8.8 billion too much! Ouch. They are attributing “serious accounting improprieties, disclosure failures and outright misrepresentations” before the deal. It didn’t name anyone, but it did blame “some” of Autonomy’s former managers. HP says it was tipped off by a remaining member of Autonomy’s team soon after Mike Lynch, the British firm’s founder and boss, was forced out in May.

Who examined the books?

People who examined the books after the sale said that Autonomy exaggerated its software sales by changing revenue from “negative-margin, low-end” hardware and by prematurely counting sales through resellers, a practice known as “channel-stuffing”.

HP has passed its findings to the Securities and Exchange Commission in America and the Serious Fraud Office in Britain. It also says it will sue.

But what about due diligence you may ask!

Mike Lynch has said that HP carried out ‘intensive’ due diligence through KPMG and bankers from Barclays and Perella Weinberg. He said that “it is sad to see how (Autonomy) has been mismanaged since its acquisition.”

How could this have happened? Advisors are paid exorbitant sums to carry out these checks. Even after the sale, it went un-noticed for a while. Advisors know the tricks that companies like Autonomy get up to. Their auditors, Deloitte, signed off their accounts. HP’s Board approved the purchase, offering a premium of more than 60%.

Meg Whitman

Meg Whitman

The People behind it

The same HP board that was there at the time of the buyout is still there today. “We feel terribly about that,” said Meg Whitman, HP’s boss, but “the board relied on audited financials.” When someone is “concealing the truth”, it is “difficult to uncover that”, added HP’s general counsel, John Schultz.

Ms Whitman noted that her predecessor, Léo Apotheker, and the then head of strategy, Shane Robison, “the two people that should have been held responsible” internally, had departed.

Heads did roll. Léo Apotheker was sacked just after the buyout. He was only a year in the job. He says he is “stunned and disappointed” by the turn of events. Shareholders got nervous.

Meg Whitman is trying to steady the ship, but it seems to be sinking. The share price is falling ($50 to $12); sales are dropping in PCs, printers, services and servers. The only light to shine is an increase in sales in software of 14%.

HP has also written down other company purchases, $8 billion on EDS which it bought in 2008 for $13.9 billion and $1.2 billion of Compaq which it bought in 2002.

How more can HP take?

By Bob Tallent

Copyright © 2012, DPNLIVE – All Rights Reserved

- Details

- Written by Administrator

- Parent Category: Business and Finance

- Category: Company News/Finances/Banks

10n2 Biz Protect 10n2 Technologies Confirms Investment of $1 million by Enterprise Ireland.

10n2 Biz Protect 10n2 Technologies Confirms Investment of $1 million by Enterprise Ireland.

An Irish mobile technology company, 10n2 Technologies, has announced that Enterprise Ireland has invested in their company. This is part of an overall $1 million investment led by Cranberry Capital, which now values the organisation at $30 million.

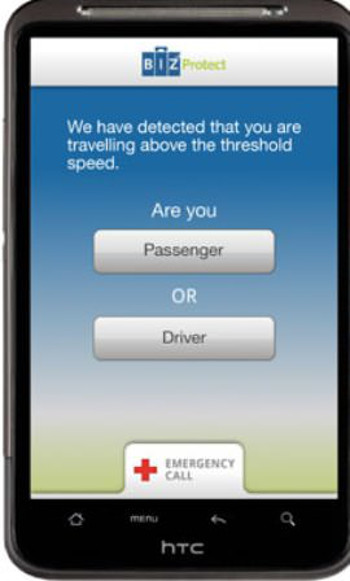

10n2 was established in 2009 and now has offices in Dublin, Boston and Dubai. Earlier this year it launched an anti-distracted driving software which is now available in the Irish marketplace. The new technology prevents drivers’ texting or browsing the internet on their smartphones while driving. The company maintains that it is designed to save lives by promoting safer driving, helping to enforce current driving laws and protecting drivers from the dangers of driving when attention is diverted from the road due to the use of smart phones. 10n2 is also developing technology to monitor speed by road classification and other driver safety systems.

Tom Cusack, Enterprise Ireland Manager High Potential Start-ups said: “Enterprise Ireland has worked closely with 10n2 and is delighted to support this highly innovative export-oriented company. It is very encouraging to see an Irish company developing a world-class product which will help tackle the risks associated with distracted driving. 10n2 is an example of the innovative, creative and entrepreneurial companies Enterprise Ireland is keen to support, and we look forward to continuing to work with 10n2 to further develop their international business.”

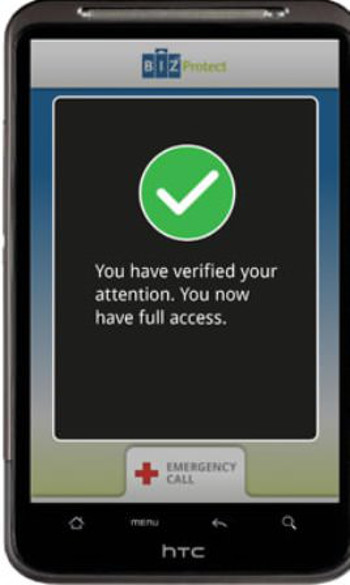

Ciaran Hynes, CEO, 10n2 Technologies added: “We are delighted to get the support and backing of Enterprise Ireland, which further strengthens our position in the marketplace internationally. Our technology saves lives. It is also the only software of its kind in the market that effectively differentiates between a passenger and driver by using our patent-pending “Attention Verification Test”. We know our technology will reduce accidents and fatalities on our roads. We are also excited about our other driver safety technologies coming down the track.”

10n2’s new products include BizProtect™ and OneProtect™, which block the use of mobile devices while driving. BizProtect™ has been developed for businesses looking to protect their employees, while OneProtect™ is for use by consumers. Both are currently available in Android and Blackberry versions.

Visit www.10n2tek.com for additional information.

10n2 Biz Protect Copyright © 2012, DPNLIVE – All Rights Reserved

10n2 Biz Protect Copyright © 2012, DPNLIVE – All Rights Reserved

- Details

- Written by Administrator

- Parent Category: Business and Finance

- Category: Company News/Finances/Banks

Irish organisations can make strategic technology and service investments without capital outlay

ricohWith the continuing reluctance of Irish banks to offer additional or any credit facilities to businesses here the news that Ricoh has announced the launch of 'Ricoh Capital' in Ireland will be warmly welcomed. The new service is designed to provide installation leasing contracts to organisations throughout Ireland and enables companies to acquire Ricoh technology and services without capital outlay. This in turn offers the benefit for firms to manage their entire print and document solutions, including service, software and financing, with one single partner.

ricohWith the continuing reluctance of Irish banks to offer additional or any credit facilities to businesses here the news that Ricoh has announced the launch of 'Ricoh Capital' in Ireland will be warmly welcomed. The new service is designed to provide installation leasing contracts to organisations throughout Ireland and enables companies to acquire Ricoh technology and services without capital outlay. This in turn offers the benefit for firms to manage their entire print and document solutions, including service, software and financing, with one single partner.

The investment will be made available through the Ricoh Capital fund in Ireland to enable new customer deals over the next 12 months.

Ricoh Ireland said that it had tailored Ricoh Capital to support the specific needs of organisations in the country at this time and to offer businesses in Ireland increased agility and the ability to make purchasing decisions quickly.

This new service offering from Ricoh is being made available initially to its existing Irish customer base and will then be rolled out to suitable prospective customers. The company commented that it expects a significant number of organisations throughout Ireland to take advantage of this new offering, which includes full consultative and financial support.

Matthew McCann, director, Ricoh Ireland, said, "We have launched Ricoh Capital to give Irish organisations another viable option as they look to make investments which can improve their businesses today. Our research in the Irish market has shown that organisations here are seeking partners which offer increased flexibility in the way they conduct business, and also are trusted and stable. The fact that Ricoh Ireland is an important part of a successful global organisation is also crucial.

"By offering an alternative to the traditional vendor-customer relationship model that typically exists in Ireland, we are able to develop long term partnerships, delivering high standards of financial support and full collaboration with our customers' needs."

For further information, please visit www.ricoh.ie

Copyright © 2012, DPNLIVE – All Rights Reserved

- Details

- Written by Administrator

- Parent Category: Business and Finance

- Category: Company News/Finances/Banks

High level of start-ups not matched by companies growing into large-scale Irish enterprises

Ireland will miss out on a new generation of heavyweight plcs unless our enterprise policy encourages domestic businesses to achieve bigger scale, Irish Stock Exchange (ISE) Chief Executive, Deirdre Somers, said today.

Ireland will miss out on a new generation of heavyweight plcs unless our enterprise policy encourages domestic businesses to achieve bigger scale, Irish Stock Exchange (ISE) Chief Executive, Deirdre Somers, said today.

Speaking at the ”Irish Enterprise – Funding for Growth” conference in Dublin, Ms Somers said government policy on creating new businesses rightly receives considerable attention but that medium-sized companies needed greater support to address the challenges facing them specifically. The conference, organised by the ISE in co-operation with Enterprise Ireland, was attended by 300 delegates and 180 high-growth companies.

“Ireland has one of the highest levels of business start-ups in the EU but the vast majority of companies sell at a relatively early stage”, said Ms Somers.

“The Government’s enterprise policy should include an ambition to build at least 5 to 10 companies to scale with a market capitalisation of over €1 billion in the next five years whether through organic growth and/or acquisition”.

“Encouraging entrepreneurship is not an end in itself. The end must be creating companies that have scale and importance on a global stage and which will contribute economically to Ireland for decades to come”, she said.

Ms Somers said it is right to celebrate successful home-grown companies achieving lucrative trade sales but that trade sales should not be seen as the best or only option available to the owners of such businesses.

“At a national policy level, we need to start redefining success by a different metric, a different and bigger ambition,” she said.

“Right now, Ireland has companies that have the business proposition, capability and ambition to be the next Ryanair, Kerry Group or Paddy Power. There are many others that can benefit from the funding options, flexibilities and exits provided by the stock market.”

Speaking about wider market conditions, Ms Somers also said:

• Equity financing has been impacted by a flight to safety and currency concerns.

• International experience shows stock exchanges are under pressure worldwide, with the main US exchanges losing 44% of their listed companies over the last five years and London’s Alternative Investment Market losing 35% in the same period.

• Ireland benefits from having its own stock market, which provides Irish companies with access to investors and funding; it also allows investors anywhere in the world to invest in Irish companies.

• Ireland’s own market infrastructure and capital markets ecosystem provide valuable support for Irish companies and generate spin-off employment for highly skilled financial services and capital markets professionals.

Speakers included Richard Bruton, Minister for Enterprise, Jobs and Innovation; Patrick Kennedy, Chief Executive of Paddy Power plc; and Frank Ryan, CEO of Enterprise Ireland.

For further Information contact

Ailish Byrne

Head of Public Affairs and Communications

Tel: 00353 (0) 1 617 4200

Mob: 00 353 (0) 87 2380265

This email address is being protected from spambots. You need JavaScript enabled to view it." mce_' + path + '\'' + prefix + ':' + addy1854 + '\'>'+addy_text1854+'<\/a>';

//-->

Press release

- Details

- Written by Administrator

- Parent Category: Business and Finance

- Category: Company News/Finances/Banks

Acquisition brings aseptic processing capability to the group.

GlanbiaGlanbia, an international nutritional solutions and cheese group, headquartered in Ireland has strengthened its US nutritional and ingredients business with the €50m acquisition of Aseptic Solutions Inc (ASI) in Corona, California.

GlanbiaGlanbia, an international nutritional solutions and cheese group, headquartered in Ireland has strengthened its US nutritional and ingredients business with the €50m acquisition of Aseptic Solutions Inc (ASI) in Corona, California.

ASI is a manufacturer and co-packer of nutritional and dietary beverages including vitamin shots, protein shakes and 100 per cent natural fruit juices, and market sources say it is viewed as a complementary acquisition which will enhance Glanbia’s service offering to its American clients.

The purchase was funded through Glanbia’s own existing banking facilities.

In a market briefing issued by Davy Stockbrokers, an "outperform" rating was placed on Glanbia’s share price, which rose by almost 1 per cent to €6.15 on the Irish Stock Exchange.

Artisan Ireland

The Sweetest Thing

The Sweetest Thing. By Tom Byrne.Scratch the surface of Irish industry and you will find…Donegal’s Liquid Gold – Pure Rapeseed Oil

Donegal’s Liquid Gold – Pure Rapeseed Oil The healthy cooking oil favoured by Celebrity…A simply rural life at Waterfall Farm

by Hannah Bolger People are keen to connect with where their food is coming from…Tastefully Yours

Artisan producers of a delightful range of handmade chutneys, preserves, and…MILEEVEN Bees--Sarah's Honey

Mileeven Fine Foods was established in 1988 by my mum, Eilis Gough from her hobby of…Glebe Brethan Farmhouse Cheese

by David Tiernan In 1987 we won supplier of the Year Award from Drogheda and Dundalk…Graham Roberts - Connemara Smokehouse

My name is Graham Roberts and I live and work in a small fishing village, Aillebrack near…CIARA’S PANTRY: It's a Family Affair

By Ellen Neumann13th April 2012 Ciara O’Dowd grew up in the hospitality industry. Her…