Irish Stock Exchange listing figures grow to over 35,000 securities

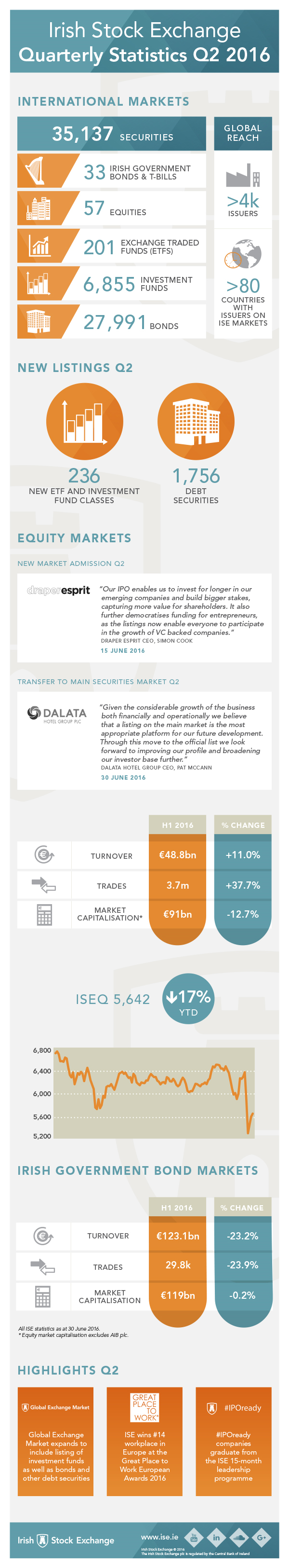

Irish Stock Exchange (ISE) infographic re Q2 2016 statistics and highlightsQuarterly statistics published by the Irish Stock Exchange (ISE) on 14 July show that the ISE has over 35,000 securities from over 4,000 issuers in 80 countries around the globe on its markets at the end of June 2016.

Irish Stock Exchange (ISE) infographic re Q2 2016 statistics and highlightsQuarterly statistics published by the Irish Stock Exchange (ISE) on 14 July show that the ISE has over 35,000 securities from over 4,000 issuers in 80 countries around the globe on its markets at the end of June 2016.

- Debt listings grow by 2.7% to 27,991 in Q2

- ETFs from Wisdomtree, Powershares and Deutsche Bank among 236 new fund listings

- Draper Esprit raises €102m from IPO on the Enterprise Securities Market

- Dalata Hotel Group transfers its listing to the Main Securities Market

- Record level of equity trades at 3.7m year to date

- #IPOready companies graduate from the ISE leadership programme

- ISE is highest ranking financial services workplace in Europe

Debt listings grow by 2.6% to 27,991 in Q2

New debt securities admitted in the second quarter of 2016 were 1,756, increasing the number of bond listings on the ISE’s two debt markets – the Global Exchange Market (GEM) and the Main Securities Market (MSM) to 27,991 (Q1 2016: 27,265), a rise of 2.7%.

Among the global companies listing new debt instruments on the ISE during Q2 2016 were:

- Entertainment One, the Canadian-based multinational entertainment and media distribution company, which listed a stg£285m bond on GEM.

- Bright Food Singapore Holdings, which is part of state-owned enterprise Shanghai SASAC, a large conglomerate in China which has its core business in food products, listing a €400m guaranteed note.

- Banco de Sabadell, the fourth largest privately-owned banking group in Spain, which listed €500m in subordinated notes on the MSM.

- Coöperatieve Rabobank, the Dutch-based international financial products and services provider, which listed a €1.25bn bond on GEM.

- Sacyr, the Spanish global infrastructures and services company, which listed its first paper from its €300m European commercial paper programme.

- Liberty Mutual Group, the USA-based provider of insurance products and services, which listed €750m in senior notes due 2026 on GEM.

ETFs from Wisdomtree, Powershares and Deutsche Bank among 236 new fund listings

There were 236 new investment fund classes admitted in Q2, bringing the number of funds on the MSM to just over 7,000 at the end of Q2 2016 (Q1 2016: 7,027).

Notable listings in the second quarter in 2016 include a number of new ETFs from providers such as Wisdomtree, Powershares, UBS and Deutsche Bank. The period also saw a number of umbrella funds established as ICAVs list as well as the first investment fund listings on the GEM, which was expanded in April to include investment funds as well as debt securities.

Draper Esprit raises €102m from IPO on the Enterprise Securities Market

Draper Esprit plc, the venture capital investor focused on long term investment in digital technologies, raised €102m from its Initial Public Offering (IPO) in June when it joined the ISE’s Enterprise Securities Market and the AIM market in London. Draper Esprit has invested over US$1 billion in more than 200 businesses in the UK, Ireland and throughout Europe.

Dalata Hotel Group transfers its listing to the Main Securities Market

Also in June, Dalata Hotel Group, the largest hotel operator in Ireland, transferred its listing to a primary listing on the Main Securities Market (MSM). The MSM was hailed by their CEO, Pat McCann as “the most appropriate platform” for their future development adding that the company looked forward “to improving our profile and broadening our investor base further."

Record level of equity trades at 3.7m year to date

Half year figures for 2016 show continuing strong growth in equity trading activity year-on-year. Turnover year to date was €48.8bn (H1 2015: €44bn) a rise of 11%. Equity trades reached record levels for six months, with a 37.7% increase in the number of equity trades to 3.7m trades (H1 2015: 2.7m trades).

ISEQ index down 10.6% amid uncertainty in global markets and Brexit decision

The ISEQ Overall index fell by 10.6% in the quarter and 16.9% year to date to 5,642 (end Q1 2016: 6,309 and end 2015: 6,792), reflecting continued uncertainty in global markets and the impact of the UK’s decision to leave the EU in late June. The half year saw most global indices deliver negative returns, including the FTSE 250 (-6.7%); the CAC 40 in France (-8.6%) and Tokyo’s Nikkei 225, which was down by 18.2%.

Irish Government bond turnover drops by 23.2%

Irish Government bond markets saw a lower level of activity for the first six months of 2016 compared to 2015 with turnover standing at €123bn (H1 2015: €160bn), a drop of 23.2%. Market capitalisation remained stable at €119bn and there was a 2.3% rise in the all bond index during H1 to 121.44 (end 2015: 118.68).

#IPOready companies graduate from the ISE leadership programme

- Cup Print – a leading producer of printed personalised paper cups in Europe specialising in short to mid-size runs and fast delivery.

- Epicom Food –creators of innovative retail milk powder-based products for China and MENA.

- Impedans – specialists in the delivery of high performance and high resolution plasma diagnostics solutions to customers in research and industry.

- Integrity 360 – a provider of information security solutions for their clients’ networks, infrastructure and data.

- Netwatch - a global provider of remote CCTV monitoring and protection systems for home and business premises.

- Mcor Technologies - an innovative manufacturer of the world’s most affordable, full-colour, safe and eco-friendly 3D printers.

- Sign+Digital Materials – distributor of sign making and digital printing equipment, supplies and training.

- Storm Technology a business technology consultancy organisation specialisings in Microsoft technology.

- Version 1 – a provider of technology enabled solutions and services to businesses in the UK and Ireland.

ISE is highest ranking financial services workplace in Europe

In June, the ISE was placed 14th in the Best Workplace in Europe awards in the small to medium category by Great Place to Work®. The award makes the ISE the highest ranking financial services workplace in Europe, the best Irish workplace in its category and follows its win as the Best Medium Workplace in Ireland earlier this year.