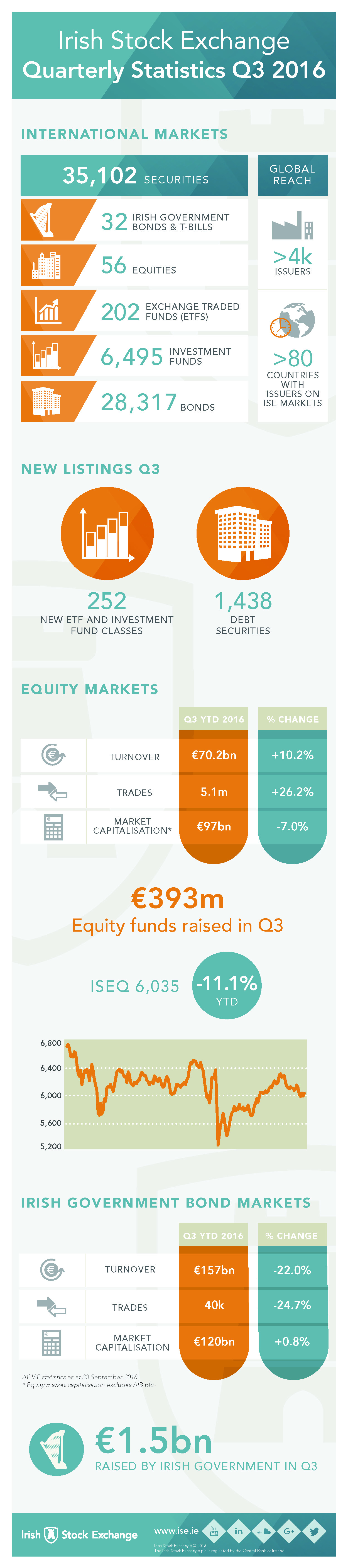

Q3 2016 statistics show over 35,000 securities listed on Irish Stock Exchange markets

Irish Stock Exchange Quarterly Statistics Q3 2016Listings on ISE markets exceed 35,000 securities

Irish Stock Exchange Quarterly Statistics Q3 2016Listings on ISE markets exceed 35,000 securities- 1,438 new debt listings in Q3 including Canadian, Latin American and European issuers

- Funds from Babson Capital, WisdomTree and Franklin Templeton among 252 Q3 new fund listings

- Equity trades up 26% and turnover 10% ahead year-to-date

- ISE-listed companies raise €393m in new equity in Q3

- ISEQ Overall index increases by 7% during Q3

- Irish Government raises €1.5bn through new bond issuance during Q3

Listings on ISE markets exceed 35,000 securities

Quarterly statistics published by the Irish Stock Exchange (ISE) today show that, at the end of September 2016, the ISE had over 35,000 securities from over 4,000 issuers in 80 countries around the globe listed on its markets.

1,438 new debt listings including Canadian, Latin American and European issuers in Q3

Total new debt securities admitted in Q3 2016 was 1,438, increasing the number of bond listings on the ISE’s two debt markets – the Global Exchange Market (GEM) and the Main Securities Market (MSM) to 28,317.

The new debt listings during the quarter included issuers from the Americas and Europe.

Among the Canadian corporates listing bonds were:

- Cott Corporation, one of the world’s largest producers of beverages on behalf of retailers, brand owners and distributors, which raised €450m through its listing on GEM,

- CPPIB Capital Inc, the capital markets financing subsidiary of Canada Pension Plan Investment Board, which listed a C$25bn debt issuance programme on GEM, and

- Valeant Pharmaceuticals, the international speciality pharmaceutical and medical device company, which listed €1.5bn in senior notes on GEM.

Latin American bond issuers included:

- CLISA, a leading Argentinian infrastructure manager and developer, which became the first company from Argentina to list bonds on the ISE when it raised US$200m from international investors. The CLISA bond was admitted to GEM;

- Banco Santander-Chile, part of the Santander Group, which provides commercial and retail banking services in the Chilean market, listed a $5bn MTN programme on the MSM,

- Sigma Alimentos, the Mexican chilled food producer and distributor, which listed a US$1bn bond on GEM.

Counted among the debt issuers from Europe were:

- Naviera Armas, the Spanish provider of shipping services in the Canary Islands, which listed €232m senior notes.

- Hemsö Fastighets AB, a Swedish property company which owns, manages and develops buildings for community services in Sweden, Germany and Finland which listed €500m notes.

Funds from Babson Capital, WisdomTree and Franklin Templeton among 252 Q3 new fund listings

There were 252 new investment fund classes admitted during Q3 2016. Among the new fund listings were funds from Babson Capital, WisdomTree and Franklin Templeton.

At the end of the quarter the ISE had almost 6,700 funds and ETFs on its markets and is the #1 venue worldwide for listing funds according to the World Federation of Exchanges.

Equity trades up 26% and turnover 10% ahead year-to-date

Data on turnover and number of trades showed a continued strong interest from investors in equity trading on the ISE’s market. Share turnover reached €21.4bn with the year-to-date figure standing at €70.2bn, an increase of 10% on the first 9 months of 2015.

Trades executed during the quarter were 1.5m which brought the total for the first 9 months of 2016 to 5.1m, an increase of 26% on the same period in 2015.

The average daily turnover for equities stood at €368m per day in the period January to September 2016, up from €335m in the same period in 2015.

ISE-listed companies raise €393m in new equity funds in Q3

ISE-listed companies raised €393m during the quarter. Companies raising funds from international investors included resource companies Kenmare, Providence and Aminex, fruit importer and distributor Fyffes and global medical devices company Mainstay Medical.

ISEQ Overall index increases by 7% during Q3

The ISEQ Overall index increased by 7% during the quarter to 6,035. This represents a fall of 11% year-to-date, reflecting turbulent global markets which has seen many European indices deliver negative returns.

Irish Government raises €1.5bn through new bond issuance

The Irish Government raised €1.5bn during the quarter from bonds listed on the ISE, bringing the total raised so far in 2016 to €8.1bn.