This Week In Business

Print’s not dead. How Hearst is using social to power-up its papers.

Analizo launches Europe's first algorithm-as-a-service, bringing robo-investing capabilities to the wealth management industry

Applegreen wins prestigious European SME Award

Mimaki Tx300P-1800 already proving a Fashionable Choice

Irish Stock Market

Applegreen wins prestigious European SME Award

Star of 2016 award won by Applegreen Applegreen, the #1 motorway service area operator in…Irish Stock Exchange Quarterly Statistics Q3 2016

Q3 2016 statistics show over 35,000 securities listed on Irish Stock Exchange markets…ISE shows growth

Irish Stock Exchange listing figures grow to over 35,000 securities Quarterly statistics…Irish Stock exchange extends to 28 companies

Dalata Hotel Group joins the ISE’s Main Securities Market Dalata Hotel Group (Dalata),…#IPOready companies graduate from ISE leadership programme

High-potential companies have graduated from #IPOready #IPOready is the Irish Stock…Quarterly Statistics - Irish Stock Exchange

Q1 2016 statistics show 34,382 securities listed on ISE markets. Main headlines: Listings…ISE The Place To Be!

Irish Stock Exchange wins No.1 slot in Great Place to Work Awards. Would you like a great…Venn Life Sciences Joins The ESM

Adding a euro quotation for investors. Venn Life Sciences, the growing Contract Research…

World Economy

Print’s not dead. How Hearst is using social to power-up its papers.

The Newspaper business is dead? Don’t tell that to Hearst. By Brett Lofgren | September…Press Release From ISE

ISE and NASDAQ OMX announce intention to bring Dual ISE/US Market Access to Irish…Sappi First-Quarter Profit Falls

Company says result is due to paper and pulp price decline. Sappi Ltd., the world’s…How global manufacturing is changing.

Ireland is changing and the savvy business has to be aware of changing global trends.3D…High Consumption Foodstuffs in DRC:

High Consumption Foodstuffs in DRC: Where Are the Surpluses and Deficits? By Dr…Xerox wins print contract for UK Government

Xerox to deliver cost efficiencies in print services to UK public sector The UK Cabinet…Disposable income drops

New figures just released show that household disposable income in Ireland fell by 0.4…Ireland’s richest 300 worth €62bn

The 300 richest people in Ireland are now worth more than €62bn. The figure is staggering…

Business & Finance

Applegreen wins prestigious European SME Award

Irish Stock Exchange Quarterly Statistics Q3 2016

ISE shows growth

Irish Stock exchange extends to 28 companies

#IPOready companies graduate from ISE leadership programme

Quarterly Statistics - Irish Stock Exchange

World Stock Market

Hans‐Ole Jochumsen re‐elected as FESE President

Euro rates fixed – but for how long?

GLOBAL STOCKS and COMMODITIES

Snapshot of Irish shares and European stocks over Christmas

Markets surge on Central Banks' intervention

U.S. Stocks Update Wednesday 23rd November 2011

Economy, Tenders & Invenstment

Prior information notice of tender.

Tender Opportunity Here at DPNlive, we are always looking for business opportunities for…Print tenders

Want to do the printing for the Houses of the Oireachtas? Below is a table of three…

- Details

- Written by Bob Tallent

- Parent Category: Business and Finance

- Category: World Economic Updates

The Newspaper business is dead? Don’t tell that to Hearst.

By Brett Lofgren | September 12, 2017

NewsWhip’s Global CRO Brett Lofgren discussed the future of “print” in an interview with President of Hearst Newspapers Digital Media, Robertson Barrett.

In the age of digital, how are print papers adapting? In the journalism industry, we constantly hear that print is dead. Last month, the New York community lost an iconic brand when the Village Voice announced plans to discontinue their print operation after 60 years. For those under a certain age, this publication was once the pulse of the city: good, bad and everything in between.

Read more: Print’s not dead. How Hearst is using social to power-up its papers.

- Details

- Written by Administrator

- Parent Category: Business and Finance

- Category: World Economic Updates

ISE and NASDAQ OMX announce intention to bring

Dual ISE/US Market Access to Irish Companies.

iseAt the Web Summit held in Dublin today (30th October), the Irish Stock Exchange (ISE) and NASDAQ OMX (NASDAQ:NDAQ) announced their intention to bring dual ISE/US market access to Irish companies enabling them to raise capital more easily on both sides of the Atlantic.

iseAt the Web Summit held in Dublin today (30th October), the Irish Stock Exchange (ISE) and NASDAQ OMX (NASDAQ:NDAQ) announced their intention to bring dual ISE/US market access to Irish companies enabling them to raise capital more easily on both sides of the Atlantic.

- Details

- Written by Administrator

- Parent Category: Business and Finance

- Category: World Economic Updates

Company says result is due to

paper and pulp price decline.

sappiSappi Ltd., the world’s biggest maker of glossy paper, said its first-quarter profit fell 62 per cent due to lower paper and pulp prices.

sappiSappi Ltd., the world’s biggest maker of glossy paper, said its first-quarter profit fell 62 per cent due to lower paper and pulp prices.

The Johannesburg-based company said that net income declined to $17 million, or 3 cents a share, in the three months through December compared with $45 million, or 9 cents, a year earlier.

A statement by Sappi said, “The pulp business continued to be negatively impacted by pulp prices that are five per cent lower than the equivalent quarter last year, and 3 percent lower than the prior quarter”.

Sappi, also the largest producer of dissolving wood pulp, is hoping on the product to increase profit which will allow it to resume dividend payments. It stopped dividend payouts in 2008 as it grappled with a high debt burden and decreasing paper sales in its major market, Europe.

Sappi returned to profitability during late 2012 and set a target for 2013 to cut borrowings by $300 million a year to a ratio of twice earnings before interest, taxes, depreciation and amortization.

Follow us on Twitter - @DigiPrintNews

Like us on Facebook www.facebook.com/dpnlive - click the ‘LIKED’ button/top of page as well

Copyright © 2013, DPNLIVE – All Rights Reserved

- Details

- Written by Administrator

- Parent Category: Business and Finance

- Category: World Economic Updates

Ireland is changing and

the savvy business has to be aware

of changing global trends.

3D and Digital Printing are examples of market changes.

By Bob Tallent

Managing Director of The Synergy Group

22nd November 2012

It strikes me that the old term of ‘economies of scale’ in terms of production is yesterday’s expression. As we all know, digital printing has been around for years and has, to an extent, revolutionised the printing industry. But printing small quantities is not the sole role of digital printing. You have read on this site many articles in the past on 3D printing, also known as additive manufacturing because it involves building up material layer by layer. It can be used to make such things as prototypes, hearing aids, toys, machine parts, medical implants, and that’s just the start of the list. The process has been around for 10 years or longer, but is it going to hit the high street in a similar way as digital printing?

It strikes me that the old term of ‘economies of scale’ in terms of production is yesterday’s expression. As we all know, digital printing has been around for years and has, to an extent, revolutionised the printing industry. But printing small quantities is not the sole role of digital printing. You have read on this site many articles in the past on 3D printing, also known as additive manufacturing because it involves building up material layer by layer. It can be used to make such things as prototypes, hearing aids, toys, machine parts, medical implants, and that’s just the start of the list. The process has been around for 10 years or longer, but is it going to hit the high street in a similar way as digital printing?

This week on 20th November, Bre Pettis, the founder of MakerBot, opened his first retail shop in New York. MakerBot are manufacturers of low-cost 3D printers and the retail shop will sell desktop MakerBots, which prints things out of plastic, for just $2,200. It is still early days, but MakerBots and machines like them are “empowering people to make the things they want, rather than buy them from factories,” says Mr Pettis.

As I mentioned, 3D printers have been around for years, use different technologies, and are advancing the whole time. MakerBot are now selling them at a retail price of $2,200 whereas Morris Technologies sell them for around $500,000. Their machines are used to print objects and parts for engineers. This week, GE bought the company for an undisclosed sum. Their plans are to use the printers to print metal parts for a new GE jet engine.

Companies like Objet and CDRM can print 3D objects from CAD drawings. So that means corrections can be made to a product without the need for full scale production runs, as was the case up to now.

Manufacturing the Future

“Manufacturing the Future” is a new report by the McKinsey Global Institute and it says that another 1.8 billion consumers will join the global market place within the next 15 years. This is optimistic news. Compare the goods which were bought with print buying in previous years. In order to make it economical, print had to be purchased in larger quantities. Now it can be bought in small quantities and as we all know, even down to one product. It will probably be similar in the future for other items. Large volume manufacturing of the same product will probably change to smaller quantities of different products. I’m not saying that large quantities and cheap manufacturing in places like China, South Korea, Indonesia and developing countries will disappear. What I am saying is that there will be a shift in demand to one offs and smaller quantities.

MakerBotTo give you an idea of how manufacturing trends have changed in the last ten years: Measured in nominal value added, by 2010 China surpassed Japan to become the second-largest manufacturing nation in the world, after America. A decade earlier it was in fourth place. In the same period, Brazil jumped from 12th to 6th and India from 14th to 10th. Britain slipped from 5th to 9th.

MakerBotTo give you an idea of how manufacturing trends have changed in the last ten years: Measured in nominal value added, by 2010 China surpassed Japan to become the second-largest manufacturing nation in the world, after America. A decade earlier it was in fourth place. In the same period, Brazil jumped from 12th to 6th and India from 14th to 10th. Britain slipped from 5th to 9th.

Here in Ireland we can see the changes ourselves. As countries get richer, manufacturing tends to account for a smaller share of their GDP. We are in that position and our share of manufacturing is decreasing.

What seems to be happening in the developed countries is that in the past 30 years or so, there has been a shift from manufacturing to service based industry which has a higher value added. For example, today, manufacturing share of GDP in China is at 33% whereas in Britain and France it is 10%.

Manufacturing Categories

McKinsey has divided manufacturing into five categories, which ties in with the notion that manufacturing these days describes a whole range of activities. These are

- global innovation for local markets

- regional processing

- Energy and resource-intensive commodities

- Innovative global technologies

- labour-intensive tradeables

The total value of global manufacturing in 2010 was $10.5 TRILLION.

One of the categories ‘global innovation for local markets’ accounts for a whopping 34%. This category includes industries like chemicals, machinery and car making, where constant innovation is essential and logistics including high transport costs for heavy goods make it sensible to produce these things close to customers.

“Regional processing” accounts for 28% and includes industries such as fabricated metals, food and publishing. For obvious reasons, bread is baked locally because it goes stale quickly and also because local tastes vary.

“Energy and resource-intensive commodities”, such as wood, paper and petrol, account for 22%.

“Innovative global technologies” (chips, computers and medical products) are 9%.

“labour-intensive tradeables” (textiles, clothes and toys) stands at 7%.

Richer Countries

Richer Countries

Ireland is growing richer – you may not think that in the present climate. And one of the things we are suffering from is a shortage of skilled educated people that companies need. We are in the same position as most of the other richer countries. For example, American firms such as Dow and DuPont are crying out for better education in engineering, technology, science and mathematics. The rich world still leads in high-tech industries.

Manufacturing vs Services

McKinsey asks another question. What is the different between manufacturing and services? In my Industrial Engineering years in the 70’s and 80’s I was able to distinguish. But, I’m finding it harder today. In my days, manufacturing used people of lower skill and education. Not today. Manufacturing today needs highly educated and skilled people. These are for the higher value added industries and these are the ones that Enterprise Ireland is trying to encourage.

McKinsey also says that there will be more robots in manufacturing. In the last 20 years the cost of automation versus the cost of labour has dropped by 40-50% in the rich world. Manufacturing in rich countries is using more robots because the cost of labour has risen. Like the rest of the developed and developing world, the cost of labour in China is rising and one Chinese manufacturer is considering using 1 million robots. Who builds these robots? People.

As Bob Dylan said ‘the Times, they are a Changin’’.

By Bob Tallent  Bob Tallent

Bob Tallent

Copyright © 2012, DPNLIVE – All Rights Reserved

- Details

- Written by DR Jean Pierre Eyanga

- Parent Category: Business and Finance

- Category: World Economic Updates

High Consumption Foodstuffs in DRC:

Where Are the Surpluses and Deficits?

By Dr Jean-Pierre Eyanga Ekumeloko

Dr Jean-Pierre Eyanga EkumelokoKeen observers of the Democratic Republic of Congo have surely noticed a general decline, in the past 20 years, of the countries agricultural production. This has resulted in a collateral effect with deficits in areas where there used to be surpluses back in the 1970s and 1980s.This has occurred because of various combined factors, including civil unrest, lack of coherent policies, poor resource management and lack of transport infrastructure maintenance, even though highly educated and capable people are available in the relevant ministries.

Dr Jean-Pierre Eyanga EkumelokoKeen observers of the Democratic Republic of Congo have surely noticed a general decline, in the past 20 years, of the countries agricultural production. This has resulted in a collateral effect with deficits in areas where there used to be surpluses back in the 1970s and 1980s.This has occurred because of various combined factors, including civil unrest, lack of coherent policies, poor resource management and lack of transport infrastructure maintenance, even though highly educated and capable people are available in the relevant ministries.

The DRC agricultural policy aims to enable people to take charge of their own lives, produce enough food to ensure a balanced diet in quality and quantity, and improve the human development parameters. The overall objective of this agricultural policy is to ensure food security for the Congolese people and reduce poverty. As an impact, it will lead to a sustainable agricultural development which will create added value and boost the national economy.

According to ANAPI, the Congolese national agency that holds investment promotion, specific objectives include the following:

- to ensure sustainable agricultural development to revive the national economy;

- to improve farmers' income with an increase in agricultural productivity, livestock and fisheries;

- to create good paying jobs in rural areas in the agri-food, industrial and artisanal sector;

- to ensure food security for Congolese people;

- to reduce poverty.

Statistics show that the agriculture sector plays an important role in production, with almost 70% of the national workforce, over 10% in 1997, 46% of GDP in 2006, 36% on average over 2007-2010, 55% in 2010 against 40% in 1960. It is estimated that currently, the sector is growing at two per cent per year.

A very brief overview of the structure of the DR Congo’s economy shows, as is the case for many developing economies, that the agricultural sector contributes the most to economic growth. Although mineral and ore exports comprised 89% of total export earnings in 2008, mineral extraction accounted for only nine per cent of GDP in 2009.

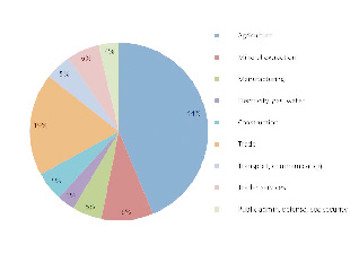

Fig.1: Composition of GDP (2009)

composition-of-GDP

composition-of-GDP

Based on the data from the Banque Centrale du Congo.

congo agricultureWithout either trying to exonerate decision and policy makers from their responsibilities or minimise the impact of other hindrances to the development of the DRC agriculture, one can certainly join Dr Hubert Ramazani, the General Secretary of the Ministry of Agriculture, Fisheries and Livestock in recognising that with various armed conflicts the country has known since 1998, especially affecting rural areas, the agricultural sector has been the most affected. It has known the destruction of all agricultural heritages. Today, the country is now getting back on track, towards recovering, rehabilitating and developing its lost assets.

congo agricultureWithout either trying to exonerate decision and policy makers from their responsibilities or minimise the impact of other hindrances to the development of the DRC agriculture, one can certainly join Dr Hubert Ramazani, the General Secretary of the Ministry of Agriculture, Fisheries and Livestock in recognising that with various armed conflicts the country has known since 1998, especially affecting rural areas, the agricultural sector has been the most affected. It has known the destruction of all agricultural heritages. Today, the country is now getting back on track, towards recovering, rehabilitating and developing its lost assets.

The most important food crops are cassava, plantain, maize, groundnut and rice. Very often, cash crops (Coffee, palm oil, sugar, cocoa, rubber, cotton, tobacco, tea, quinquina and papain) are produced by small farmers for both internal consumption and export needs. In fact, worldwide specialists recognise that the DRC holds tremendous capacity to feed more than two and a half billion people; yet with only ten percent of its 227 million hectares of land suitable for agriculture, and only 1-2% of arable land actually in use, it currently struggles to feed its population of 68 million.

According to the United Nations Development Programme, approximately 21 million people in the DR Congo are food insecure. At the 2004 Agriculture Roundtable, policy makers supported by donors and other development partners noticed the food insecurity and suffering facing almost 70% of the country population, thus they produced a common strategic document that outlined the approaches and actions to tackle these problems in other to successfully address the situation. Furthermore, in 2008 and 2009, respectively 72% and 71% of the population were estimated to be food insecure and, living below the poverty line. One study estimated that 27% of surveyed households consumed only one meal a day.

This significant number of food insecure people and the country's high poverty head-count are largely the result of decades of poor political, economic, and social  Animal_husbandry_in_Congopolicies. These have resulted in under-investment in basic infrastructure and nearly nonexistent social services. The country that was once a major exporter of food products, such as coffee, cassava, palm oil, palm kernel and tea, is now a major importer of these products.

Animal_husbandry_in_Congopolicies. These have resulted in under-investment in basic infrastructure and nearly nonexistent social services. The country that was once a major exporter of food products, such as coffee, cassava, palm oil, palm kernel and tea, is now a major importer of these products.

Besides, the International Food Policy Research Institute (IFPRI) has blamed the government's lack of support for agriculture for continuing food insecurity in the country. Indeed, many farmers have struggled to gain access to credit and there has been a prolonged lack of both public and private investment in agriculture, as well as in the country's energy and transport infrastructure. Recent global food price rises have hit the import-dependent DRC hard.

Farming is predominantly low-input and subsistence-based, with farming methods based on the use of hand tools and traditional methods (slash-and-burn farming, with long fallow periods); there is little commercial activity, particularly in the wake of the civil war and other conflict. Steps need to be taken so that the majority of Congolese households can be moved away from situations where they are obliged to practice subsistence agriculture and rely on informal employment opportunities for income, such as the sale of agricultural products, petty trade, and contract work.

However, the country is gradually regaining ground, especially through the field of seed production which is the basis of agriculture in a country. The revival of the seed sector is already successful in some provinces, such as Bandundu, Bas-Congo, Province Orientale and Katanga.

Nowadays, three types of agriculture production systems coexist in the DR Congo: traditional agriculture, modern agriculture and "group agriculture” Traditional agriculture primarily focuses on food crops, and accounts for over 80% of the country's production. Modern agriculture, which began in colonial times, is based on modern means of production. This type of agriculture is limited in the DR Congo, and mainly includes large agribusiness companies that operate large areas with high yields; it is most commonly used for export crops. "Group agriculture" involves group farming supported by cooperatives (and, in some cases, religious organizations) and arose from a long-standing absence or ineffectiveness of national rural development services that favour labourers.

Almost all farms in the DR Congo are small-scale (less than one hectare) and fall under the traditional agriculture characterization. Traditional farms are mostly run by peasants, who account for 70% to 80% of rural populations. According to the results of baseline surveys carried out in 2009 by Action Contre la Faim in Kivu Provinces (2005 – 2008) and Food for the Hungry in North Katanga District, a study in one district found that the income of the average rural household member earns less that US$0.25 per day, 25% of which is made up by the sale of agricultural produce. Moreover, 68% of rural households' income is spent on food.

Almost all farms in the DR Congo are small-scale (less than one hectare) and fall under the traditional agriculture characterization. Traditional farms are mostly run by peasants, who account for 70% to 80% of rural populations. According to the results of baseline surveys carried out in 2009 by Action Contre la Faim in Kivu Provinces (2005 – 2008) and Food for the Hungry in North Katanga District, a study in one district found that the income of the average rural household member earns less that US$0.25 per day, 25% of which is made up by the sale of agricultural produce. Moreover, 68% of rural households' income is spent on food.

With regard to modern agriculture, the DRC Bellmon Analysis 2007 states that only a handful of large farmers (which account for less than 10% of all of the country's farmers) have animal traction or mechanized technology, and nearly all of those are located in southern Katanga province, which also recently saw the development of some medium-sized farms of 10-30 ha.

According FAOSTATS, , the DR Congo on average produces 1.5 million MT of cereals, 1.2 million MT of coarse grains, 330,000 MT of oil crops, 195,000 MT of pulses, and 16 million MT of roots and tubers. The current annual production is around 20 million MT for all crops combined, which is far from sufficient to meet national demand.

Official statistics show that the DR Congo imports an annual average of:150,000 MT of frozen fish, 80,000 MT of frozen chicken, 60,000 MT of palm oil, 10,000 MT of milk powder, and 40,000 MT of sugar. MIDEMA reports imports of about 400,000 MT of wheat.

With a 3% population growth per year and a steady decline in food production, experts notice an increase in the inability of the DR Congo to meet its food requirements, as shown in the following table which highlights estimated food needs of certain crops for Kinshasa. FAO Statistics 2006 for cereals and pulses show that the country's food deficit is estimated at between 20 and 30 percent, depending on regions.

Table 2: Balance of Commodity Needs in Kinshasa (2008)

Food stuffs | estimated needs | Calculated Annual | Deficit (%) |

Maize (Flour) | 438.227 | 72.593 | 83 |

Cassava (Flour) | 374.836 | 84.426 | 78 |

Shelled groundnuts | 88.196 | 9.373 | 89 |

Palm oil | 90.952 | 29.300 | 68 |

Dry Bans | 281.127 | 17.601 | 93 |

Source : Enquête FAO/IFPRI 2008.

The main crops grown in the DR Congo include tubers (mainly cassava), plantains, maize, rice, groundnuts, and beans. The table below shows the decline of production of major agricultural commodities in recent years.

Table 1: Agricultural Production (2000 to 2006)

Production | 2000 (in MT) | 2009 (in MT) | Rate of |

Maize | 1,184,000 | 1,156,180 | 2.3 |

Cassava | 15,959,000 | 15,034,450 | -5.8 |

Rice paddy | 337,800 | 316,880 | -6.2 |

Ban. plantain | 526,735 | 490,470 | -6.9 |

Oil Palm | 1,119,190 | 1,148,099 | +2.6 |

Coffee | 42,380 | 24,000 | -43.4 |

Cacao | 6,300 | 10,000 | +58.7 |

Meat (Cattle) | 13,500 | 12,340 | -8.6 |

Poultry (production) | 11,600 | 10,737 | -7.4 |

(Source: Ministère de l'Agriculture, de l'Elevage et de la Pêche, FAO; FAO statistics are for 2009, except for meat and poultry which are 2008 figures).

northeastern-congolian-lowland-forests-mapTo tackle this deficit situation, Government has decided to use three different approaches: projects, humanitarian assistance in some areas and programmes where a wide range of activities come into play in a well defined area. Thus, a $120 million programme with the World Bank is now being implemented in the northern part of the Province of Equateur to boost agricultural production through: (i) rehabilitation of infrastructure (roads of agricultural importance and construction of warehouses); (ii) rehabilitation of equipment e.g. base stations for INERA (National Institute for Studies and Research in Agriculture) to produce seed; (iii) rehabilitation of some rivers to improve navigation. With IFAD, in Province Orientale, there is a range of various programs with different components including roads, health centres equipment, construction of schools, etc...

northeastern-congolian-lowland-forests-mapTo tackle this deficit situation, Government has decided to use three different approaches: projects, humanitarian assistance in some areas and programmes where a wide range of activities come into play in a well defined area. Thus, a $120 million programme with the World Bank is now being implemented in the northern part of the Province of Equateur to boost agricultural production through: (i) rehabilitation of infrastructure (roads of agricultural importance and construction of warehouses); (ii) rehabilitation of equipment e.g. base stations for INERA (National Institute for Studies and Research in Agriculture) to produce seed; (iii) rehabilitation of some rivers to improve navigation. With IFAD, in Province Orientale, there is a range of various programs with different components including roads, health centres equipment, construction of schools, etc...

According to Dr Ramazani, animal farming has suffered in DR Congo, especially in the eastern part of the country where big animals were either completely destroyed or taken away to neighbouring countries because of war. In North and South Kivu, Ituri (Province Orientale), North Katanga, Bas-Congo, Bandundu and both Kasai, efforts are being made to revive cattle production. With regard to poultry and pigs, local production is facing a very strong and unfair competition from low cost imported products.

Without any risk to be mistaken, one can see that even though some measures are taken and resources allocated to the agriculture sector, further seriously coherent national policies have to be made and tangible strategic steps taken, supported by a genuine political will of the country’s leadership to create a national, strong and competitive agriculture, as the one Congo had prior to its independence, which made this country at that time the biggest agriculture power in Africa.

The four strategic pillars identified in the Document de la Stratégie de Croissance et de Réduction de la Pauvreté (DSCRP) 2 are very relevant here: (i) improve access to markets, rural infrastructure and trade capacity; (ii) increase crop, livestock, fisheries and artisanal production; (iii) strengthen governance as well as institutional capacity and human resources, (iv) organize the rural world in self-managed structures and provide funding for the sector.

The Congolese leadership don’t need to re-invent the wheel but rather take advantage of and learn from the expertise, knowledge, technology and experience accumulated by countries like Ireland and Brazil to improve its own production, transformation and management capacity in order to make the countries agriculture highly productive and competitive.

Bibliography:

- http://africanews.cd/index.php?option=com_content&view=article&id=1732:hubert-ali-ramazani-dresse-un-état-des-lieux-&catid=71:movies&Itemid=415

- ANAPI (2008), Investir dans le secteur agricole et de l’élevage en RDC.

- Eyanga E, J.-P. (2012), Report on the fact finding and exploratory mission in the Democratic Republic of Congo for a future trade mission (unpublished).

- UNDP (2009), Human Development Indicators.

- WFP, Ministère du Plan, Institut National de la Statistique (2008), République Démocratique du Congo : Analyse globale de la sécurité alimentaire et de la vulnérabilité (CFSVA

- http://www.usaidbest.org/docs/DRCBellmon2010.pdf

- http://www.new-ag.info/en/country/profile.php?a=641#.UGWRBpjA8zI

- Rapport Bilan Diagnostic (2009), p. 61.

- ACF and Food for the Hungry (2009), Results of Baseline surveys by ACF in Kivu Provinces”2005 – 2008” and in North Katanga District.

- DRC Bellmon Analysis 2007.

- FAO Stats 2010.

- FAO Statistics 2006 for cereals and pulses.

- FAOSTATS.

- ITC data base.

- Data from the Banque Centrale du Congo.

- République Démocratique du Congo (2011), Document de la Stratégie de Croissance et de Réduction de la Pauvreté(DSCRP) 2.

By Dr Jean-Pierre Eyanga Ekumeloko

Chief Executive Officer

GEE Consulting

Lecturer

Representative of the Bel Campus University of Technology in Ireland and the UK

Tel: 00353 (0)86 3767403

Email: This email address is being protected from spambots. You need JavaScript enabled to view it." ' + path + '\'' + prefix + ':' + addy2767 + '\'>'+addy_text2767+'<\/a>';

//-->

Website: www.gee-consulting.com

https://www.facebook.com/GEEconsulting

Skype: eyangajp

Copyright © 2012, DPNLIVE – All Rights Reserved

Artisan Ireland

The Sweetest Thing

The Sweetest Thing. By Tom Byrne.Scratch the surface of Irish industry and you will find…Donegal’s Liquid Gold – Pure Rapeseed Oil

Donegal’s Liquid Gold – Pure Rapeseed Oil The healthy cooking oil favoured by Celebrity…A simply rural life at Waterfall Farm

by Hannah Bolger People are keen to connect with where their food is coming from…Tastefully Yours

Artisan producers of a delightful range of handmade chutneys, preserves, and…MILEEVEN Bees--Sarah's Honey

Mileeven Fine Foods was established in 1988 by my mum, Eilis Gough from her hobby of…Glebe Brethan Farmhouse Cheese

by David Tiernan In 1987 we won supplier of the Year Award from Drogheda and Dundalk…Graham Roberts - Connemara Smokehouse

My name is Graham Roberts and I live and work in a small fishing village, Aillebrack near…CIARA’S PANTRY: It's a Family Affair

By Ellen Neumann13th April 2012 Ciara O’Dowd grew up in the hospitality industry. Her…